National and Macroeconomic Overview

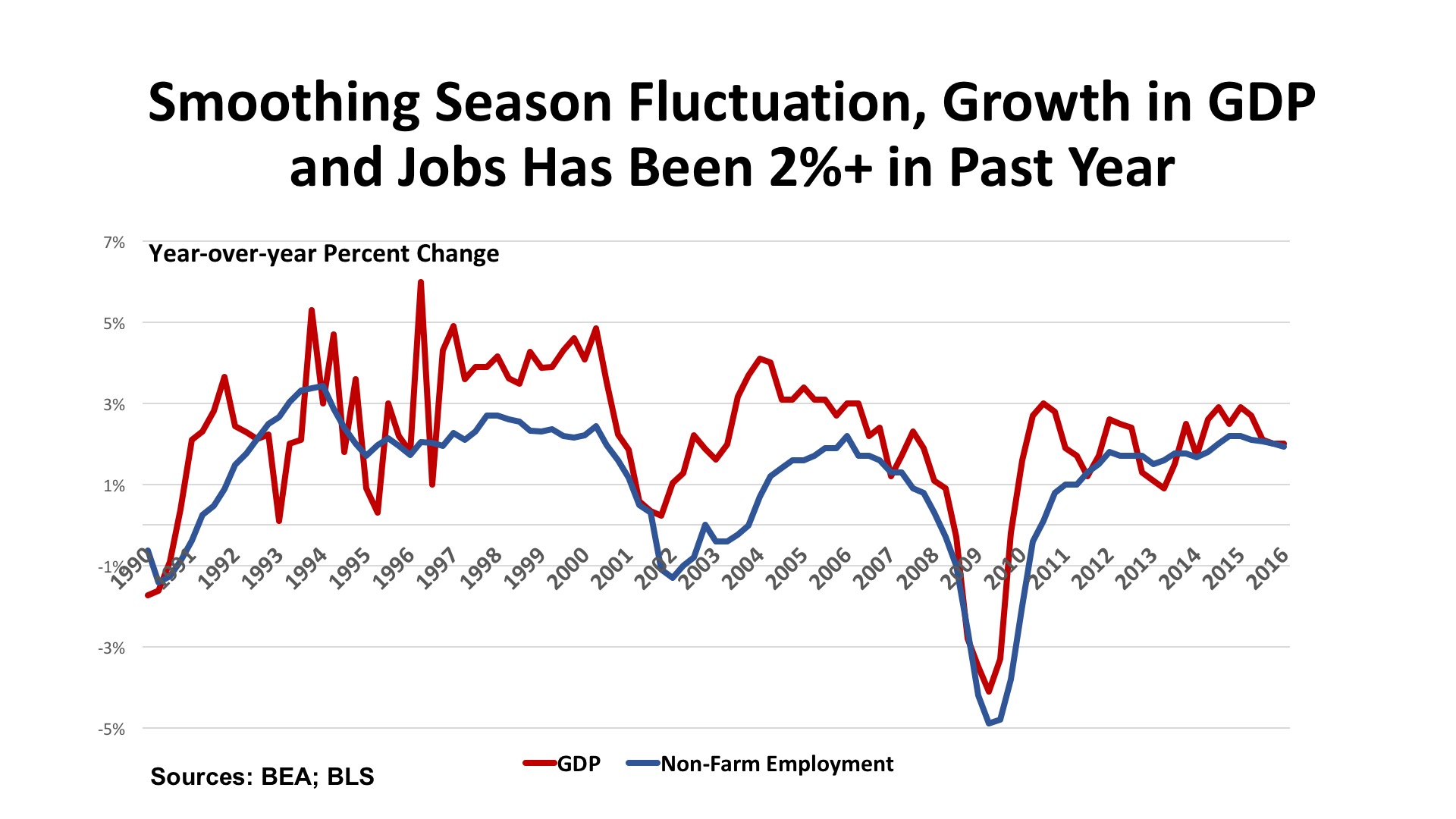

It seems the first half of the year was marked by multiple episodes of unpredictable weather across the United States. The same could be said of the economy. Another disappointing First Quarter showed real GDP growth of just 1.1% (although this was revised upward from the initial estimate of 0.5%). Private sector economists still anticipate that the pattern of a second half rebound will hold again in 2016, and the outlook for growth in 2017 remains above 2.0%.

Jobs. Employment growth slackened in the Spring. The May jobs estimate was especially weak at just 11,000. But then the June figure came in with a robust gain of 287,000. Most industries have been stable to slowly growing over time, but the temporary adjustment of 35,000 jobs due to the Verizon strike (counted as job losses in May and gains in June) skewed the month-to-month change. Year-over-year, net job change was up 2.45 million, or 1.7%. Total employment hit a new high for the U.S. at 144.1 million, up 10% from the trough of the Great Recession and 4% higher than the pre-recession peak. The unemployment rate, meanwhile, stands at 4.9%, and the consensus of economic forecasts anticipates a further, albeit slower, decline in the jobless rate for the next 18 months.

Policy. Of course, the shockwave of the Brexit, the United Kingdom’s referendum vote to leave the European Union, was yet another unexpected jolt in late June. The financial markets plunged as a result, but had largely recovered their losses by July 1 and achieved new historic highs thereafter. Volatility, however, appears to have put on hold any near-term increases of interest rates from the Fed. Uncertainty in Europe may be increasing the flow of “flight capital” into the U.S., and into hard assets like real estate. Based on past experience, New York is likely to receive a disproportionately high share of any capital seeking safe-harbor in the United States. What could compromise this outlook? Concerns that the U.S. will retreat from its evolving engagement with the global economy in a world that is ever more integrated in merchandise and services trade, and capital flow. The disputes between the European Union and Great Britain will appear puny should the U.S., the world’s largest economy, retreat from its cross-border business engagements.

The Outlook. Several fundamental indicators recently released suggest that the national economy should be resilient through the coming months. The Case-Shiller Home Price Index is up 5.0% for the year, which should translate into improving consumer sales. Wages are moving up modestly, exceeding the 1.1% annual inflation rate that is well below the Fed’s target. The dollar has continued to strengthen, though, which will retard GDP growth by widening the balance-of-trade deficit. All economic news will be amplified, good or bad, by the political megaphones of this year’s extraordinary Presidential race. Claims to authoritatively interpret the numbers by either camp should, to put it mildly, be taken with a very large grain of salt.

Regional Conditions in the Central States

The Central states, with an employment base of 55.6 million, has the largest number of jobs of the three regions analyzed in our newsletters. However, with an aggregate job growth of just 631,000 spread over nineteen states, the Central region has the lowest number of additional jobs and the slowest growth rate (1.1%). Texas, with a year-over-year job gain of 171,800 (1.5%) is the regional standout in absolute growth, but Tennessee posted a faster pace of job gains, 2.1% (versus the US average of 1.7%) on the addition of 60,900 positions. On the other side of the coin, Kansas, Louisiana, North Dakota, and Oklahoma saw employment contract in the past twelve months. Unemployment ranged from a low of 2.5% in Tennessee and 3.0% in Nebraska, to highs of 6.3% in Louisiana and 6.4% in Illinois.

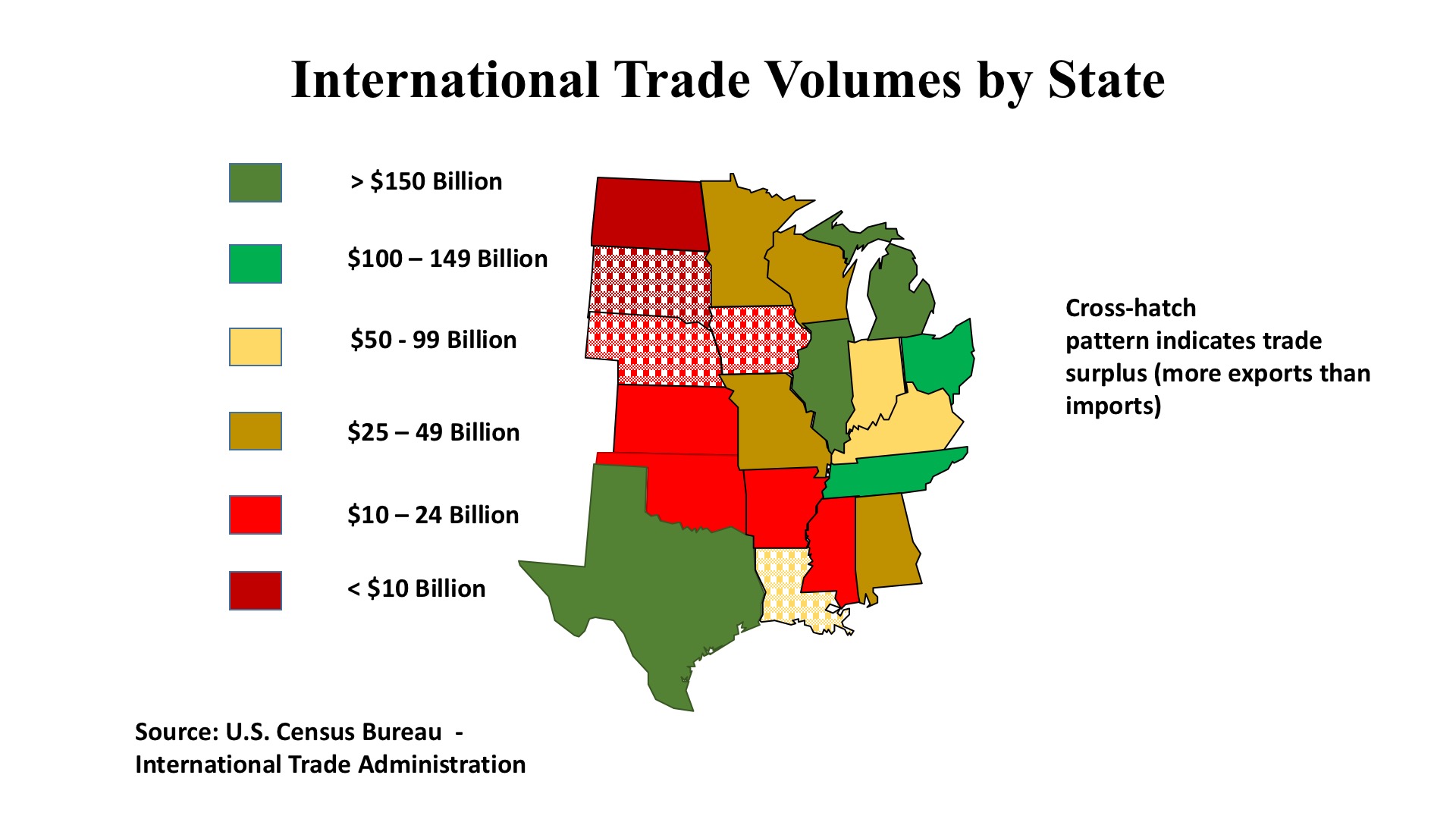

Although far from the oceans, the Central region has an extraordinary role in international trade. Texas has an annual import/export volume of $502 billion, with Michigan ($177 billion) and Illinois ($185 billion) in the top tier trade states as well. Tennessee and Ohio also engage in more than $100 billion in global trade annually. While lower in volume, four states with agricultural and/or energy concentrations in their economies show surplus trade balances (more exports than imports) in an era where the country as a whole has long been in a deep trade deficit. Texas, with its enormous total volume, has a very thin trade deficit of just $404 million. Globalization, then, has been a mixed blessing for the region – possibly costing a number of jobs, but generating employment as well in sectors ranging from agriculture and energy to transportation and wholesales, and in manufacturing sectors including precision instruments and transportation equipment.

Healthcare is reported to be a bright spot in the regional economy, as is professional and business services in and around Minneapolis, Kansas City, and Dallas. The energy slump has impacted several parts of the region, and accounts for the bulk of the economic contraction in states like Louisiana, Oklahoma, and North Dakota. Residential construction is constrained by rising labor costs and by tightening underwriting standards at bank lenders. Commercial development lending is also being carefully underwritten, limiting new development. This will have the likely effect of lengthening the real estate cycle, which has not seen the volume of construction that is typical in a late-stage business expansion. Basel III capital requirements, the regulatory impacts of Dodd-Frank oversight, and the “lessons learned” by banks caught with billions of land and development loans in the Global Financial Crisis all contribute to the constrained credit environment.

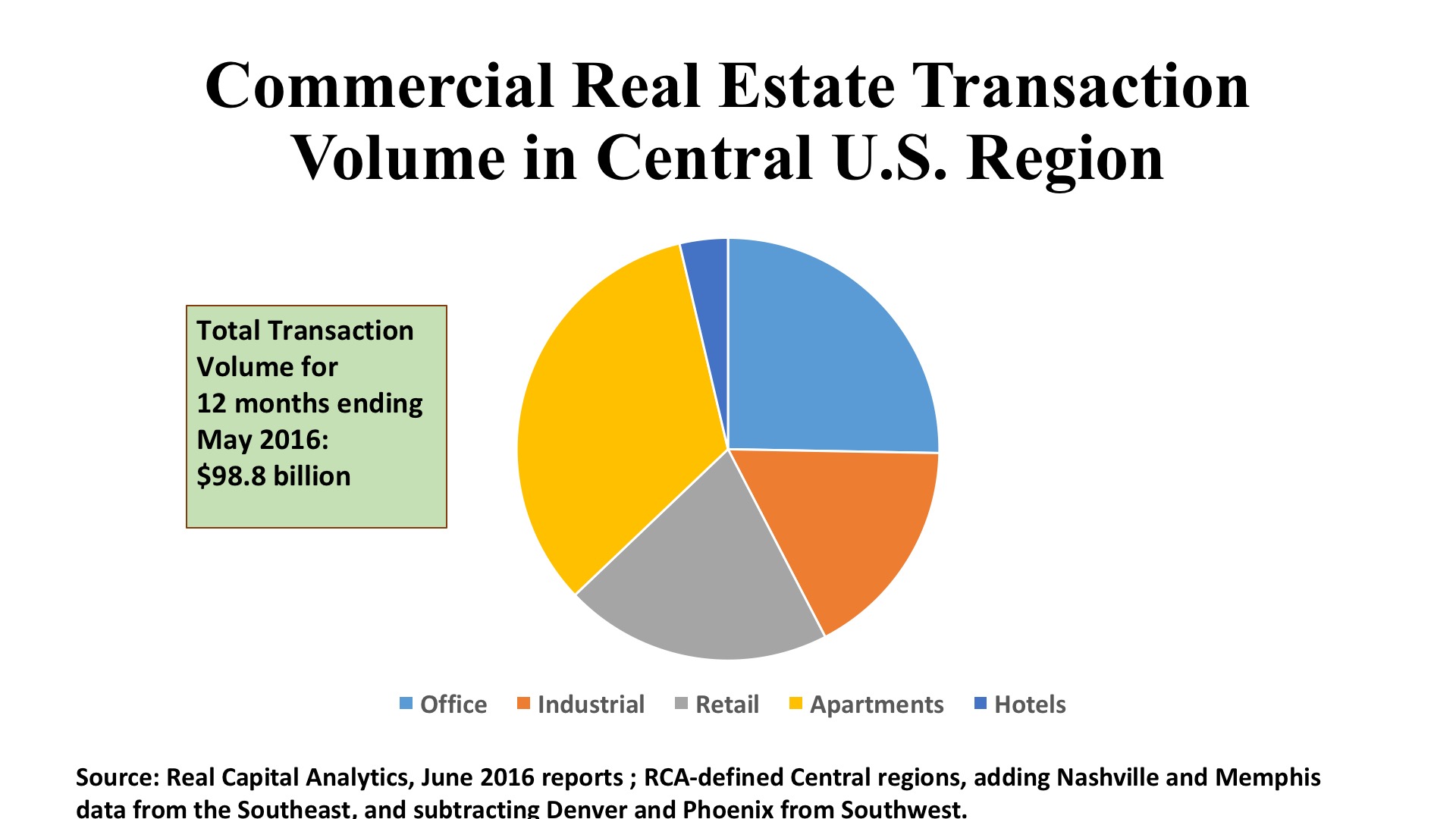

Commercial Property Investment Trends

Office. As a share to total investment volume in the past twelve months, the 25% ($25 billion) in office deals in the Central region is low compared with the East and the West. However, there is a greater balance among the property types in the Central states than elsewhere in the country. In most metro areas within the region, we find the suburbs outpacing the CBD both in deal count and in dollar volume. Chicago is the sole exception to this pattern within the region. This weighting toward the suburbs helps explain the above average cap rate (about 7.5%) and price per square foot ($162) for the Central region as a whole. Austin registers the highest average price per square foot, at $275, in a sample that covers 57 transactions in the past year. Dallas had the greatest number of individual deals, 196 (91% in the suburbs), with a comparatively low $138 per square foot price and high 7.9% cap rate.

Industrial. Industrial properties accounted for 17% of the investment volume in the Central states, the highest share of total for industrials of any region in the country. The combination of manufacturing and international trade, plus the geographic advantage of being able to reach the broad market indicated by 55.6 million workers and their families helps account for strong investment in warehousing and distribution facilities. Chicago led the region with 382 deals worth $3.5 billion, followed by Dallas (266 transactions; $2.7 billion) and Houston (136 deals; $1.5 billion) over the past twelve months. Investors appear to have satisfied their appetite for 300,000 sf+ warehouses (or else sellers just want to hold on to such assets), moving acquisition volume toward smaller (and often older) industrial properties.

Retail. Investment in the stores sector surpasses even the strong industrial volume, with $20 billion in shopping property deals representing one-fifth of the commercial real estate acquisitions in the Central region this past twelve months. This compares with a 19% share for retail in the West, and just 15% in the East. In most markets, neighborhood and community centers are the most avidly sought retail assets, accounting for approximately 60% of all transactions. Dollar volume followed a similar pattern, however, the sale of Country Club Plaza in Kansas was an exception to the general rule, tilting the statistics toward the Mall sector in that metro market. Malls did achieve substantially higher prices per square foot ($350 - $530) than strip centers, and the larger centers had cap rates about 100 basis points lower than strip centers (6.4% versus 7.4%). Food is becoming more and more a mainstay of retailing, whether that food is deployed in supermarkets, in restaurants, or in specialized food halls. As ecommerce challenges traditional retailing (Amazon is now one of the largest apparel retailers in the nation), retail real estate is increasingly seeking to provide “experiences” to shoppers – and food had an important role to play in that strategy.