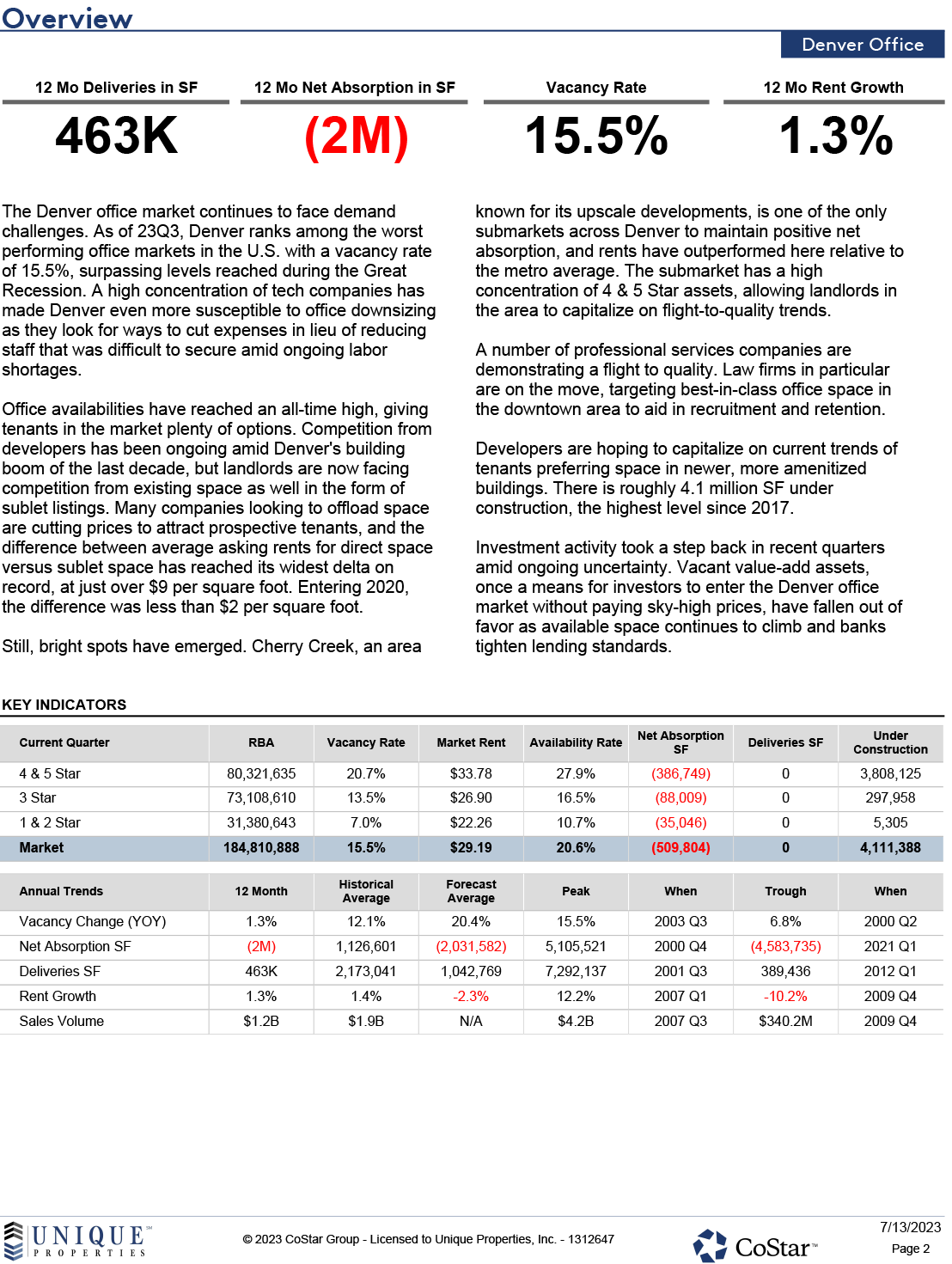

The Denver office market continues to face demand challenges. As of 23Q3, Denver ranks among the worst performing office markets in the U.S. with a vacancy rate of 15.5%, surpassing levels reached during the Great Recession. A high concentration of tech companies has made Denver even more susceptible to office downsizing as they look for ways to cut expenses in lieu of reducing staff that was difficult to secure amid ongoing labor shortages.

Office availabilities have reached an all-time high, giving tenants in the market plenty of options. Competition from developers has been ongoing amid Denver's building boom of the last decade, but landlords are now facing competition from existing space as well in the form of sublet listings. Many companies looking to offload space are cutting prices to attract prospective tenants, and the difference between average asking rents for direct space versus sublet space has reached its widest delta on record, at just over $9 per square foot. Entering 2020, the difference was less than $2 per square foot.

Still, bright spots have emerged. Cherry Creek, an area known for its upscale developments, is one of the only submarkets across Denver to maintain positive net absorption, and rents have outperformed here relative to the metro average. The submarket has a high concentration of 4 & 5 Star assets, allowing landlords in the area to capitalize on flight-to-quality trends.